Will the new mortgage disclosures delay my closing?

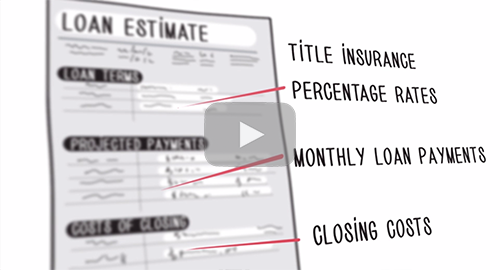

The answer is NO for just about everybody. When the Know Before You Owe mortgage disclosure rule becomes effective, lenders must give you new, easier-to-use disclosures about your loan three business days before closing. This gives you time to review the terms of the deal before you get to the closing table.

Many things can change in the days leading up to closing. Most changes will not require your lender to give you three more business days to review the new terms before closing. The new rule allows for ordinary changes that do not alter the basic terms of the deal.

Only THREE changes require a new 3–day review:

1. The APR (annual percentage rate) increases by more than 1/8 of a percent for fixed-rate loans or 1/4 of a percent for adjustable loans. A decrease in APR will not require a new 3-day review if it is based on changes to interest rate or other fees.

2. A prepayment penalty is added, making it expensive to refinance or sell.

3. The basic loan product changes, such as a switch from fixed rate to adjustable interest rate or to a loan with interest-only payments.

***Lenders have been required to provide a 3-day review for these changes in APR since 2009.

NO OTHER changes require a new 3–day review:

There has been much misinformation and mistaken commentary around this point. Any other changes in the days leading up to closing do not require a new 3-day review, although the lender will still have to provide an updated disclosure.

For example, the following circumstances do not require a new 3-day review:

- Unexpected discoveries on a walk-through such as a broken refrigerator or a missing stove, even if they require seller credits to the buyer.

- Most changes to payments made at closing, including the amount of the real estate commission, taxes and utilities proration, and the amount paid into escrow.

- Typos found at the closing table.